Your Cart is Empty

- GOLF CART ACCESSORIES

- Battery Chargers & Parts

- Battery Sets - Lithium

- Body Kits & Tops

- Brush Guards & Bumpers

- Custom Golf Cart Seat Cushions

- Dash Kits

- Enclosures & Covers

- Golfing Accessories

- Hunting Accessories

- Lift Kits

- Performance Parts

- Rear Seat Kits

- Safety Products

- Steering Wheels & Hubs

- Storage Solutions

- Wheelz & Tires

- Windshields

Deann Weddle

February 23, 2021

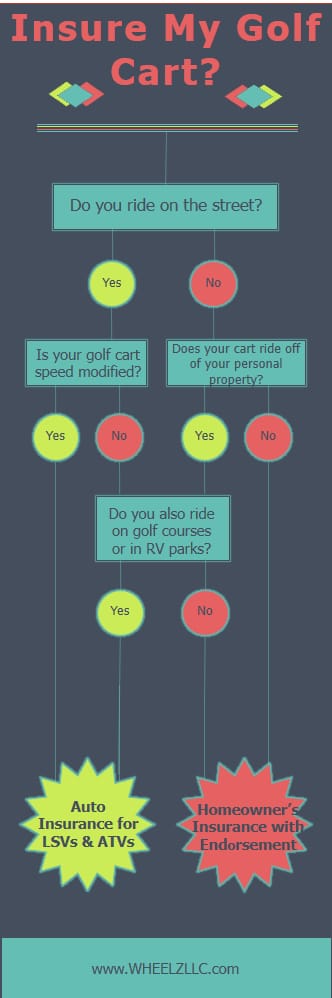

Hey there. I just dropped by to say that the infographic on ‘insure my golf cart’ was really nice element on your blog. I think these types of infographics immediately grasp the readers’ attention and gets them to read through the blog.